what is the inheritance tax in georgia

In 2022 anyone can give another person up to 16000 within the. Besides getting married or convincing your family members to move there are other steps you can take if youre trying to figure out how to avoid an inheritance tax.

Inheritance Tax Poised For A Comeback In The Post Covid Era Bloomberg

One option is convincing your relative to give you a portion of your inheritance money every year as a gift.

. Inheritance - T-20 Affidavit of Inheritance required. Avoiding Inheritance Tax. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

If the vehicle is currently in the annual ad valorem tax system the family member has the option of staying under annual ad valorem OR paying full one-time TAVT.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Your Inheritance Considered Taxable Income H R Block

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Eight Things You Need To Know About The Death Tax Before You Die

Britons Throwing Away Hundreds By Way Of Easy Inheritance Tax Errors In 2022 Inheritance Tax Inheritance Take Money

Inheritance Tax In The Uk Offshore Citizen

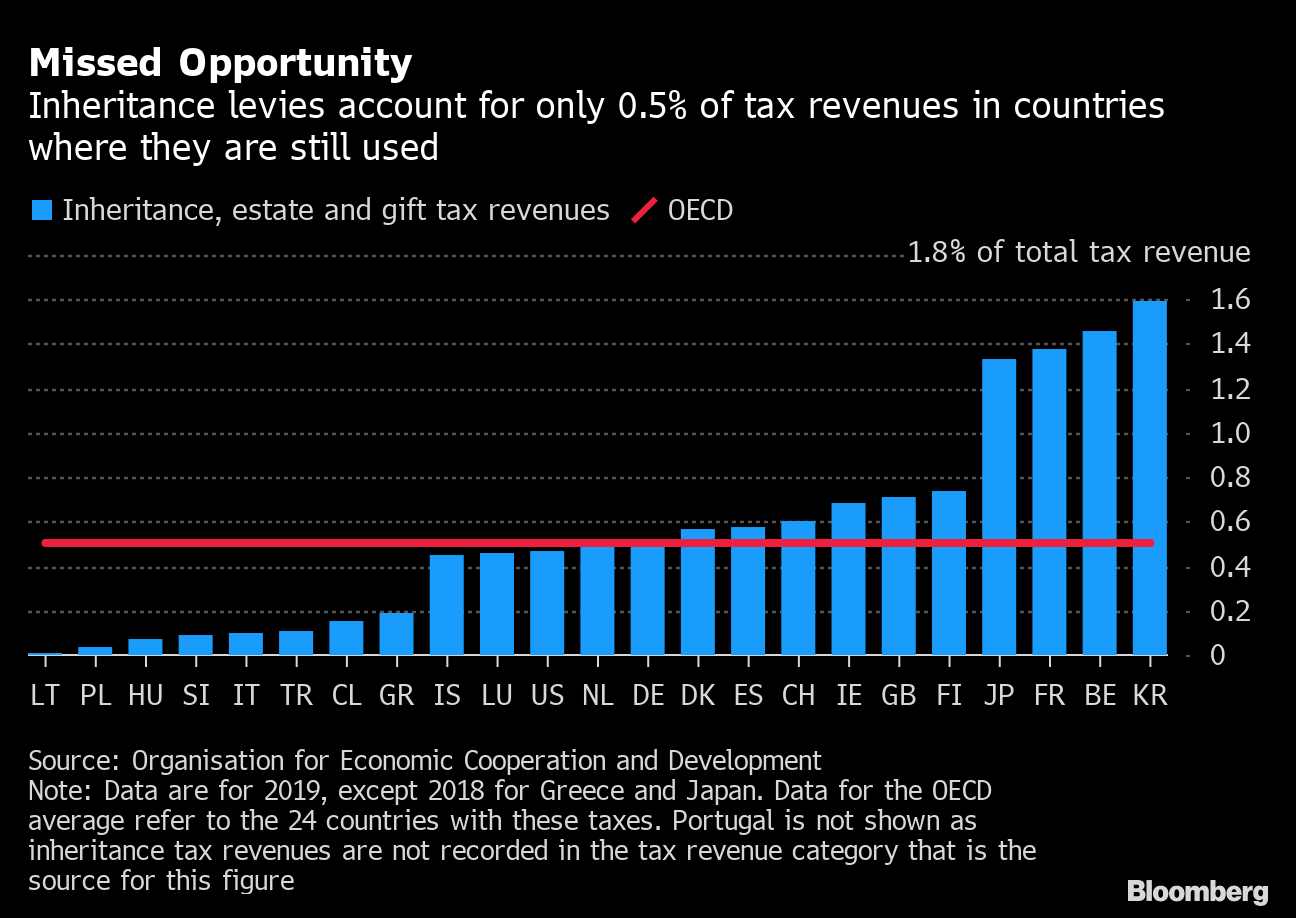

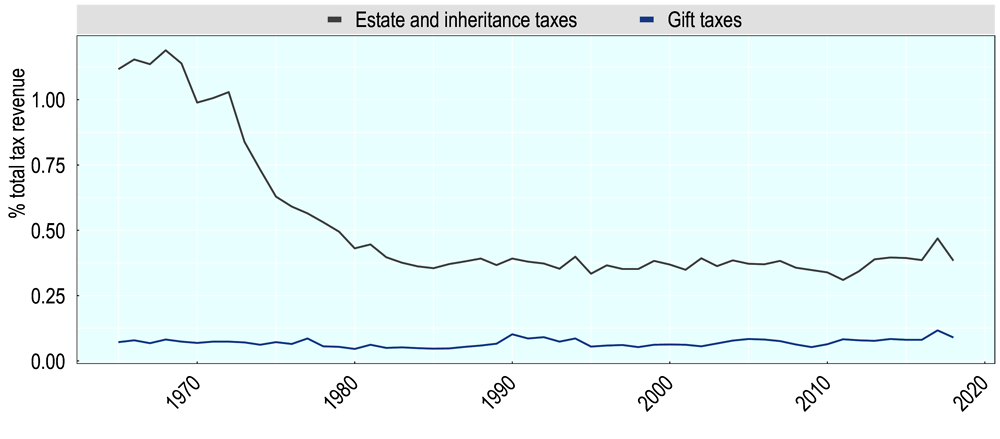

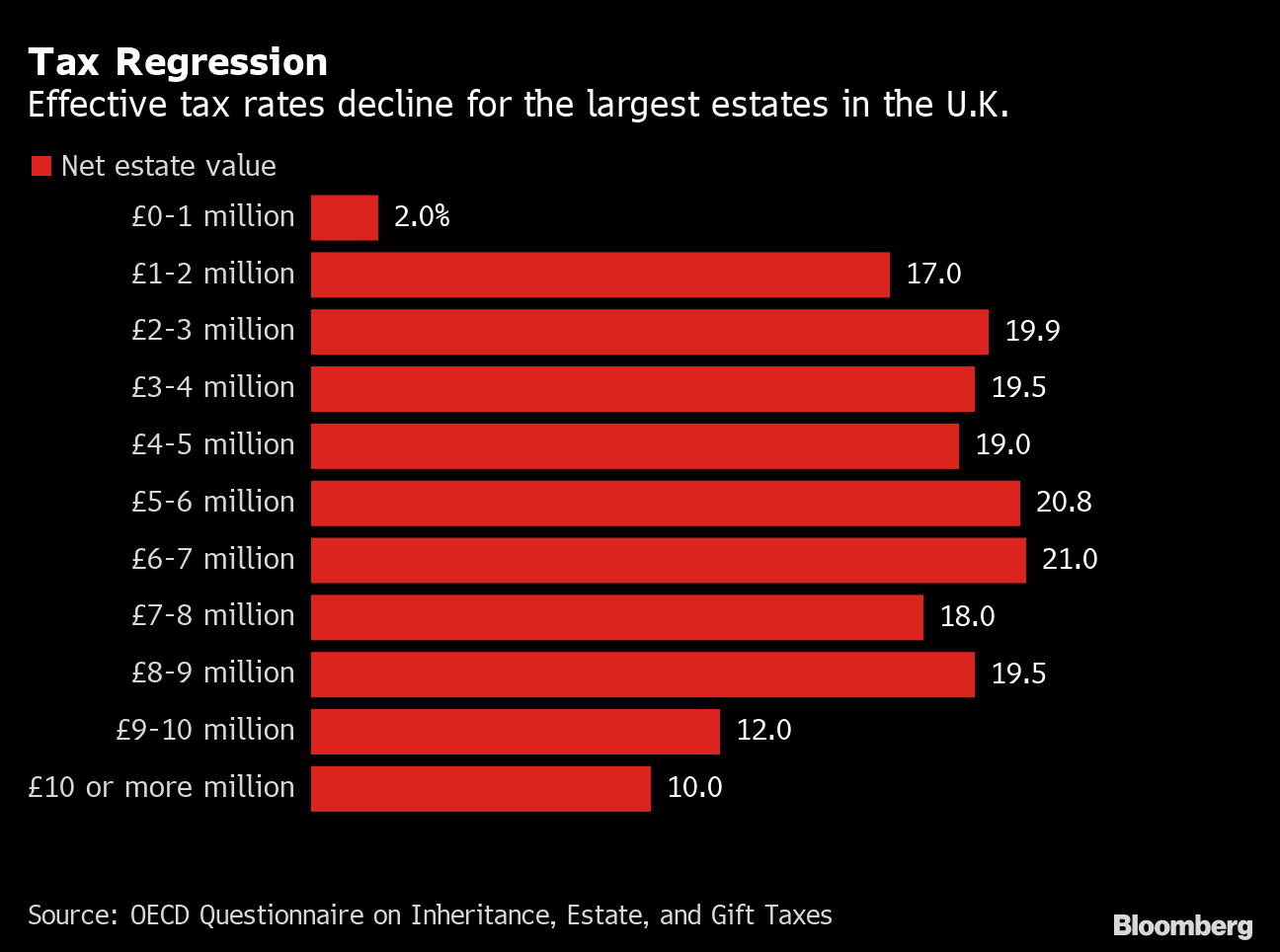

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Tax Poised For A Comeback In The Post Covid Era Bloomberg